Forex Trading vs Stock Trading Which is Better for You 1608915125

October 30, 2025 7:57 pm Leave your thoughts

Forex Trading vs Stock Trading: A Comprehensive Comparison

When it comes to trading financial instruments, two of the most popular markets are Forex (foreign exchange) and stocks. Each has its unique characteristics, advantages, and disadvantages. Understanding these differences is crucial for traders when deciding which market suits their trading style and investment goals. In this article, we will delve into the world of Forex trading vs. stock trading, discussing the key elements, benefits, and drawbacks of each. For beginners or experienced traders looking to explore various options, consider checking out forex trading vs stock trading Top Trading Platforms for insights and resources.

Understanding Forex Trading

Forex trading involves the buying and selling of currency pairs in a global market that operates 24 hours a day. Unlike the stock market, which has set hours, Forex allows traders to operate outside traditional trading hours, giving them greater flexibility. The Forex market is known for its high liquidity, meaning that large amounts of money can be transferred without causing significant price changes. This attribute attracts many traders, as they can enter and exit positions swiftly.

Advantages of Forex Trading

- Liquidity: The Forex market is one of the largest and most liquid financial markets in the world, providing traders with the ability to execute large trades without affecting the market price.

- Leverage: Forex trading often allows for higher leverage compared to stock trading, meaning traders can control larger positions with less capital. While this can amplify profits, it also increases the potential for losses.

- Access to Global Markets: Currency trading is accessible 24 hours a day, allowing traders from different time zones to participate at their convenience.

- Low Transaction Costs: Many Forex brokers offer competitive spreads, which can lower the overall cost of trading.

Disadvantages of Forex Trading

- High Risk: While leverage can amplify profits, it also escalates risks. Traders can lose their entire investment quickly if they do not manage risk properly.

- Complexity: The Forex market can be complex and unpredictable, making it challenging for novice traders.

- Limited Regulation: Though forex trading is regulated, there are relatively fewer restrictions compared to stock markets, which may lead to untrustworthy brokers.

Understanding Stock Trading

Stock trading involves buying and selling shares of publicly traded companies. Unlike the Forex market, the stock market operates during specific hours, typically from 9:30 AM to 4 PM EST. Stock trading is often seen as a more straightforward investment, as it is easier to understand and analyze individual companies’ performances, financial health, and market positions.

Advantages of Stock Trading

- Ownership: Buying stocks gives you a share of ownership in a company, allowing you to benefit from its growth and profits.

- Market Regulation: Stock markets are heavily regulated, providing greater security for investors and reducing the risk of fraud.

- Long-term Investment: Stocks can offer dividends and long-term growth potential, making them suitable for those seeking to build wealth over time.

- Research Available: There is a wealth of information available on publicly traded companies, making it easier for investors to make informed decisions.

Disadvantages of Stock Trading

- Market Hours: Stock trading is limited to specific hours, which may prevent traders from capitalizing on price movements outside of those times.

- Lower Liquidity: While many large-cap stocks are liquid, smaller stocks may not offer the same level of liquidity, making it difficult to buy or sell when needed.

- Higher Transaction Costs: Trading stocks may incur higher brokerage fees and commissions compared to Forex trading.

Similarities Between Forex and Stock Trading

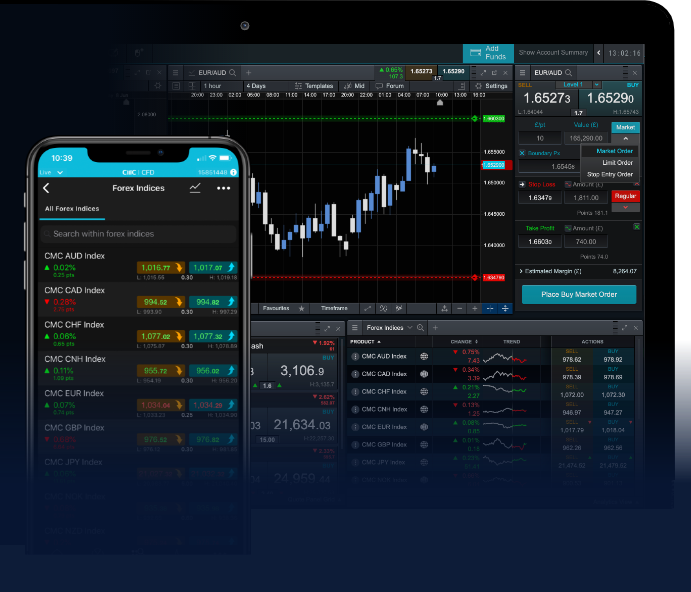

Despite their differences, Forex and stock trading share some similarities that can benefit traders. Both require a solid understanding of market analysis, whether technical or fundamental. Success in either market depends on effective risk management strategies and the ability to control emotions during trading. Additionally, both markets offer online trading platforms, making it accessible for anyone to participate from the comfort of their homes.

Choosing the Right Market for You

When deciding between Forex trading and stock trading, consider your trading style, risk tolerance, investment goals, and how much time you can dedicate to trading. If you prefer a market with more liquidity and flexibility in trading hours, Forex may be the better choice. However, if you are more interested in long-term investments and prefer the transparency of regulated markets, stock trading might be the option for you.

Conclusion

In summary, both Forex trading and stock trading have their unique advantages and challenges. Understanding these can help traders make informed decisions about where to focus their efforts. Whether you choose to trade currencies or stocks, continuous education and staying updated on market developments are crucial for success in either market. Assess your own financial goals and risk tolerance, and embark on your trading journey with the market that aligns with your preferences.

Categorised in: trading5

This post was written by euro_pred_admin