A Beginner’s Guide to Forex Trading

October 27, 2025 9:40 am Leave your thoughts

Forex Trading for Beginners: A Comprehensive Guide

Forex trading, or foreign exchange trading, refers to the global marketplace where currencies are bought and sold. It’s one of the largest financial markets in the world, with trillions of dollars traded daily. For those who are new to this environment, understanding the dynamics of Forex trading is crucial. This guide will provide you with essential insights and resources tailored for beginners. You can also check out forex trading for beginners Best Indonesian Brokers to kickstart your trading journey.

Understanding Forex Trading

The Forex market operates 24 hours a day, five days a week, and it is crucial to grasp the principles of how this market works if you want to succeed as a trader. Unlike stock markets, no centralized exchange operates Forex trading. Instead, it uses a decentralized model where buyers and sellers negotiate prices directly through various platforms.

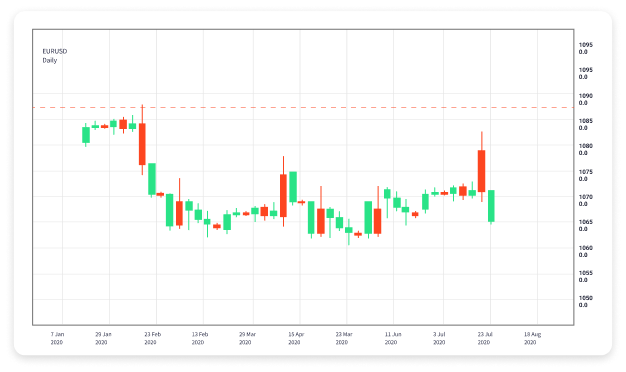

Trading currencies involves pairs where one currency is exchanged for another. For example, in the EUR/USD pair, the Euro is the base currency, and the US Dollar is the quote currency. Traders speculate on the future movement of currencies, betting on whether the base currency will appreciate or depreciate relative to the quote currency.

The Importance of Learning

Forex trading is not a game of luck; it is a discipline that requires a solid understanding of financial markets, economic indicators, and risk management strategies. New traders often make the mistake of diving in without sufficient knowledge, leading to significant losses. It’s vital to educate yourself through online resources, courses, and practice trading accounts before committing real money.

Key Terminology

Before you start trading, it’s essential to familiarize yourself with basic Forex terminology. Here are some key terms:

- Pip: The smallest price move that a given exchange rate can make based on market convention.

- Leverage: A mechanism that allows traders to control larger positions with a smaller amount of capital.

- Spread: The difference between the bid price (buy) and the ask price (sell) of a currency pair.

- Lot: A term used to describe the size of a trade. A standard lot is 100,000 units of currency.

Getting Started with Forex Trading

To begin trading, follow these steps:

- Choose a Reliable Broker: Picking a trustworthy broker is crucial. Research various platforms, check their regulation, fees, and customer service.

- Create a Trading Account: Once you’ve selected a broker, you can create a trading account. Many brokers offer demo accounts, allowing you to practice trading without financial risk.

- Learn Trading Strategies: Explore different trading strategies, such as scalping, day trading, and swing trading. Study how to read charts and analyze market trends.

- Start with a Demo Account: Use a demo account to practice your strategies. This will help you gain experience and confidence before trading with real money.

- Manage Your Risk: Always be mindful of risk management. Use stop-loss orders and only risk a small percentage of your capital on any single trade.

Technical vs. Fundamental Analysis

To make informed trading decisions, you will need to rely on either technical analysis, fundamental analysis, or a combination of both.

Technical Analysis

Technical analysis involves evaluating price charts and indicators to forecast future price movements. Traders use various tools and indicators such as moving averages, RSI (Relative Strength Index), and Fibonacci retracements to identify potential trading opportunities.

Fundamental Analysis

Fundamental analysis focuses on economic indicators and news announcements that can influence currency prices. This includes GDP reports, employment figures, interest rate decisions, and geopolitical events. Understanding the economic landscape of different countries can help you anticipate currency movement.

Developing Your Trading Plan

A well-defined trading plan is essential for success. It should include your trading goals, risk tolerance, strategies, and evaluation methods. A trading plan helps you stay focused and disciplined, crucial for long-term success in the Forex market.

Components of a Trading Plan

- Goals: Define your short-term and long-term goals.

- Risk Management: Determine how much capital you are willing to risk on each trade.

- Entry and Exit Points: Specify when to enter and exit trades based on analysis.

- Review Process: Create a method for reviewing your trades to learn and improve.

Common Mistakes Beginners Make

Many novice traders make common mistakes that can lead to losses. Here are a few to be aware of:

- Over-Leveraging: Using too much leverage can amplify losses significantly.

- Ignoring Stop Losses: Failing to use stop-loss orders can result in significant losses.

- Chasing Losses: Trying to recover losses by making impulsive trades can lead to more significant losses.

- Lack of Education: Skipping learning can impair your ability to make informed trading decisions.

Conclusion

Forex trading can be an exciting and profitable venture, but it requires diligence, education, and a strategic approach. By understanding the basics, practicing with a demo account, and developing a solid trading plan, beginners can position themselves for success. Remember to be patient and disciplined as you navigate the Forex market.

As you start your Forex trading journey, leveraging reliable resources, such as Best Indonesian Brokers, can provide you the necessary support and tools to improve your trading performance.

Categorised in: traiding1

This post was written by euro_pred_admin